Loading a sample onto a robotic arm to perform high-throughput screening. Photo courtesy of AbCellera.

The little discovery engine that could

UBC spinoff AbCellera’s rapid response to COVID-19 has multiplied its capacity for discovering more antibody therapies, targeting everything from autoimmune disease to cancer.

The antibody: it’s a very small thing with a very big potential. The right antibody at the right time can save your life. Or it can turn your fledgling UBC startup into a multi-billion-dollar company, almost overnight — although the latter possibility applies to a pretty rarified cohort.

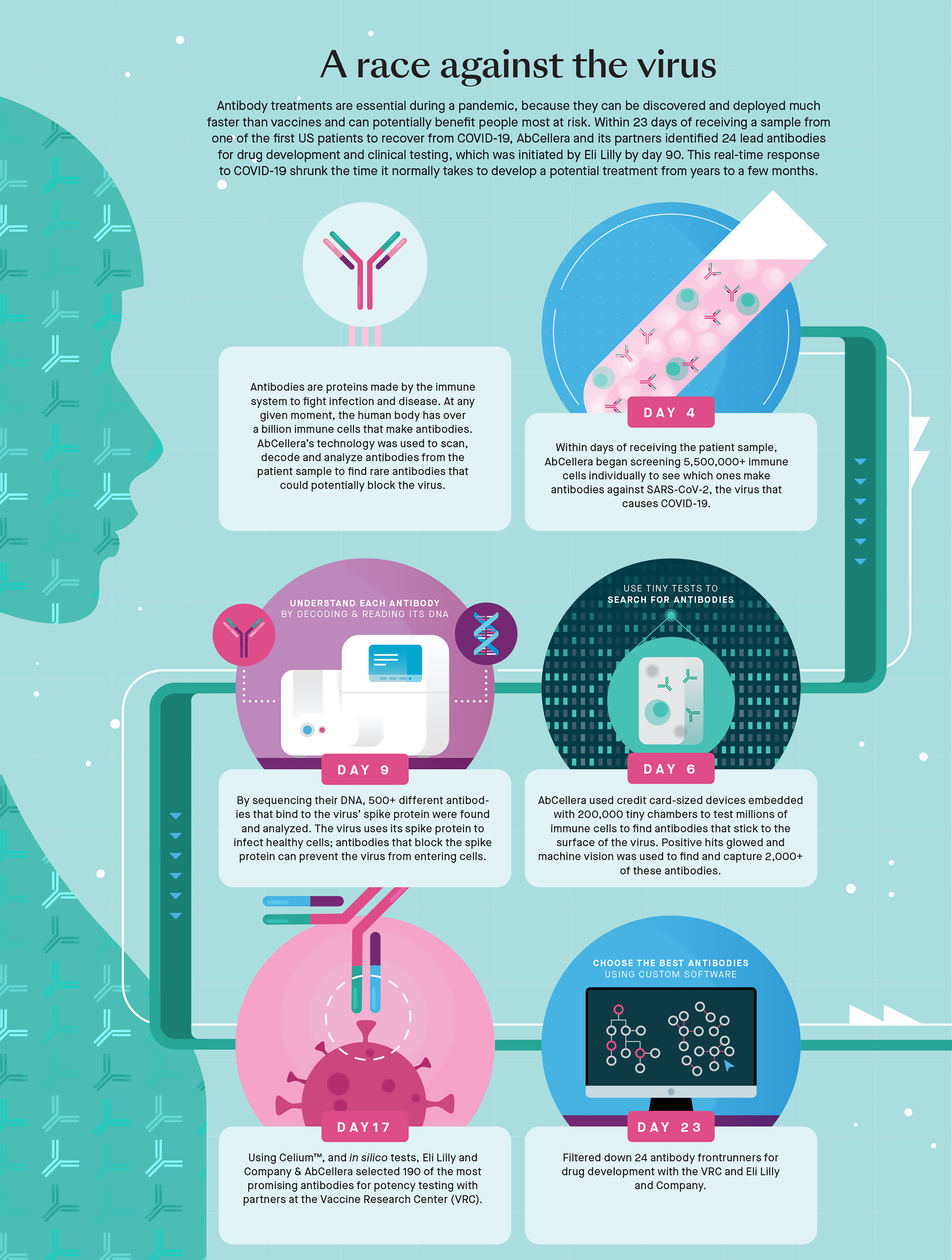

Either way, a good antibody can be hard to find. While the average person might produce a billion antibodies in a single day, they are typically versions that are designed to fend off familiar foes. If something new shows up — something like SARS-CoV-2, the virus that causes COVID-19 — your immune system is running blind. It prints out random antibody variants, working by trial and error to find one that is effective against the new threat and then hustling to make enough copies to have an impact. That can take weeks, during which you are dangerously exposed.

So, it’s nice to have help. One option is to use a vaccine — containing a “dead” virus, or a harmless feature of the pathogen — to safely introduce your immune system to a new threat. That triggers production of effective antibodies, but it still takes time for your system to react.

In an emergency (as in, when you are already sick, haven’t been vaccinated and are at heightened risk from the virus), it’s better to have access to an external supply of the right kind of antibodies. These “monoclonal” antibodies are harvested from human (or, sometimes, zoonotic) sources, and cloned — brewed in large vats. The most famous example is the monoclonal antibody treatment from the US company Regeneron that was used to rescue then-President Donald Trump last year.

But even here, time is the enemy. It’s incredibly difficult to find, refine and develop monoclonal antibodies. Véronique Lecault, the Chief Operating Officer of UBC spinoff AbCellera Biologics Inc., says that if you are using conventional technology, which dates to the 1970s, it typically takes 10 years or more to go through the discovery and development process. Yet, from a standing start last March, AbCellera took just over three weeks to find and deliver a monoclonal antibody candidate that they called bamlanivimab (named, one assumes, by scientists, not marketing people). The drug giant Eli Lilly optioned the “bam” and quickly brought it to market, winning regulatory approval and finding eager and deep-pocketed buyers all over the world. In December, when the already profitable AbCellera launched its Initial Public Offering (IPO) on NASDAQ, its $20 opening share price more than tripled and the company raised upwards of $555.5 million, ending its first day with a market capitalization of $12.65 billion. It was the largest biotech IPO in Canadian history. Again: very small antibody, very big potential.

Every individual on Earth has a capacity to fabricate “somewhere north of a trillion different antibodies, different DNA sequences – some small fraction of which may bind in a way that could make it a drug.”

Foundations

It’s tempting to restart this story in the laboratories named for UBC’s Nobel laureate Michael Smith. That’s where “Véro” Lecault did some of the groundbreaking work on which AbCellera was founded. But it’s worth stepping back even further, to introduce AbCellera’s CEO, Carl Hansen.

Edmonton born and raised, Hansen came to UBC in the 1990s to study engineering physics and honours math. He’s still proud to have attained “one of the most high-powered degrees in the country, maybe in North America.” But heading to the California Institute of Technology for a doctorate in applied physics, Hansen realized that he had a decision to make. The great challenges in physics and math are “100-plus-year-old problems” against which people have been making very little headway. “It was difficult for me to envision how I was going to contribute anything really fundamental,” he says — whereas the field of biotechnology was breaking wide open. At Caltech, the brilliant young researcher Dr. Stephen Quake was knocking down barriers in microfluidics and genomics, leading Hansen to believe that he could make a case for joining Quake’s lab based on being an engineer — someone who could build devices for biomedical research. “And by doing that,” Hansen says, “I get to work at the interface between engineering and biology and computation.” And that, clearly, is a critical interface.

Hansen finished his PhD in 2005 and returned to UBC as faculty, claiming his own bench in the Michael Smith Laboratories and building a team that was the definition of multidisciplinarity. In 2012, he broke out with former students Lecault, Kathleen Lisaingo (experimental medicine and biophysics), Kevin Heyries (biochemistry), Daniel Da Costa (engineering physics) and Oleh Petriv (cell biology), and formed AbCellera (think “Ab,” as the scientific signifier for “antibody,” and “Cell,” as in blood cell).

The excitement of starting a university spinoff can wear off quickly. There follow years of scrabbling for financing and learning to manage a complex enterprise, even while refining groundbreaking science. Some startups get bought out early, leaving founders to pocket a profit, but mourn as some American pharma swallows yet another homegrown biotech. Less often, stubborn overachievers start grinding out a small profit, but even the biggest successes usually go 10 or 15 years before being ready for launch on a public stock exchange.

The AbCellera team made the whole process look easy and quick. They doubled the size of their staff every year and attracted ever-larger grants and investments from foundations, governments and private investors, including Peter Thiel, the billionaire co-founder of PayPal and a member of AbCellera's board of directors.

In 2018, AbCellera got US$30.6 million from the US Defence Advanced Research Projects Agency (DARPA) to research antibody treatments for pandemics. The company also signed deals with some of the world’s biggest drug makers to search for antibodies useful for treating other conditions.

One of the key pieces of technology that made this all possible was “a credit card-sized antibody discovery engine” that earned Véro Lecault her PhD. Originally from Mirabel, north of Montreal, Lecault had gone to the University of Ottawa for a joint degree in engineering and biochemistry, because she loved both disciplines and couldn’t decide between them. Coming to UBC for a PhD in chemical and biological engineering, she soon found herself in Hansen’s lab — like him, bridging traditional barriers between engineering physics and biology.

If “engine” gives you an image of some tiny outboard full of complicated moving parts, it’s better to think of Lecault’s device as the world’s smallest test-tube tray — “a miniaturized fluid handling system,” as she describes it. It’s made of a clear, flexible silicone compound called polydimethylsiloxane (PDMS), which you might more commonly find in the form of contact lenses or as a shampoo ingredient (apparently PDMS makes hair shiny and slippery). In the AbCellera application, a thin layer of PDMS is dimpled with hundreds of thousands of very small chambers — nanolitre small (a nanolitre being a billionth of a litre).

In classical fashion for someone who studied advanced astrophysics, Hansen begins his description of this device by saying, “It’s not rocket science, really.” If you’re trying to make measurements on a single cell, or trying to detect an antibody that a blood cell is fabricating and sending out into the environment, you’ll be overwhelmed in a conventional volume of liquid, he says. “It would be like trying to detect a drop of orange juice in a swimming pool.” But if you take the same cell and put it into a volume 100,000 to 300,000 times smaller, you get a detectable concentration. Even better, if you can crowd hundreds of thousands of these chambers onto a piece of PDMS the size of a credit card, you can then assay hundreds of thousands of samples simultaneously – or you can if the rest of Hansen’s team is there to manage microfluidic machine vision, hydrogen microscopy, and artificial intelligence adequate to generate and track enormous quantities of data.

From scientific innovation to business application

That, then, gets to the problem and the promise of the AbCellera business model. Conventionally, the simplest road to business success is to pick one thing and do it well, or to make one product and sell it many times. But Hansen and his colleagues don’t want to start a medical device company. They want to leverage their multidisciplinary capacity to discover new antibodies, which, Hansen says, means they have to “invest along the entire stack,” bringing together specialties including biochemistry, genomics, single-cell analysis, microfluidic machine vision, instrument design (“I probably forgot some”) to come up with a single antibody that can be replicated or formulated into a treatment or drug. With bamlanivimab, they proved that they can do so — and fast.

But the AbCellera team isn’t satisfied with that, either. They don’t want to find a single drug or treatment and build out a capacity to deliver it directly to market. They want to stay in the intellectually intense (and capital intensive) space where they are discovering all the time — identifying antibodies that they can licence to big pharma companies that manufacture, distribute and sell the ultimate drug or treatment.

This is both a nuisance and a good thing. It’s a nuisance, Hansen says, because “no one really believed that was a good way to build a business until it [AbCellera] really started to catch fire last year.” It’s a good thing, though, because of another business principle: it’s risky to have too many eggs in one basket.

One giant step forward, one step back

In March last year, when AbCellera received its first COVID-infected blood sample, it took just 23 days to identify 24 candidates for development as monoclonal antibodies. Within 90 days, bamlanivimab was in clinical trials, and before the end of the year, 15 countries had authorized its use. The US offered US$1.2 billion for 950,000 doses and promoted the treatment enthusiastically. Canada paid US$21.3 million for more than 17,000 doses, but most of those continue to sit on the shelf.

In circumstances that Hansen describes as both infuriating and heartbreaking, provincial health authorities across the country balked. Despite the international uptake, Canadian officials weren’t convinced that the benefits of the treatment were worth committing the resources in an already overburdened system. (Each treatment requires a transfusion and must be administered early in the infection to be effective.) This rejection was a particular blow to AbCellera staff, some of whom had family members endure a shattering COVID infection, while being denied access to a treatment that might, at the very least, have reduced the severity and longevity of their sickness.

It can’t be a coincidence that, as governments concentrated their investment in COVID vaccines, AbCellera’s share price slid from over $70 to less than $24, before climbing back (at time of writing) to just over $30. That more than halved the value of Hansen’s own $3 billion-plus in AbCellera stock, but if he is annoyed, he is not deterred. Indeed, Hansen, who sports a Jeff Bezos hairstyle, also harbours an Amazon-level of ambition. (Asked if he might forsake management to concentrate on science, Hansen name-checked his exemplars – entrepreneurial founders who have made the jump from science nerd to CEO: “Zuckerberg, Gates, Elon Musk, Jeff Bezos – it’s hard to think of a counter example.”)

In AbCellera’s widening world, Hansen is forever talking in billions and trillions. For example, he says, every individual on Earth has a capacity to fabricate “somewhere north of a trillion different antibodies, different DNA sequences – some small fraction of which may bind in a way that could make it a drug.”

As a class of drugs, antibody-based treatments currently constitute a $240-billion industry. And AbCellera, which Hansen says has “somewhere between 50 and 70 antibody drug discovery deals with some of the best companies in the world,” is looking to find therapies for “cancer, inflammation, autoimmune disease, obesity, diabetes, cardiovascular disease, neurodegenerative disease, infectious disease, just about everything.” And while drug-company partners narrow their focus – and their potential – by concentrating on proven moneymakers, AbCellera will continue upgrading its investigative stack. It will leverage its COVID windfall and an incredible talent pool (UBC grads comprise more than half of AbCellera’s staff) to bolster its discovery engine.

So, no longer a very small thing, and the potential is bigger than ever.